Exploring Tax Advantages of Real Estate and Business in Jackson Hole

When comparing tax friendly states across the US, Wyoming offers significant benefits. According to The Tax Foundation’s State Business Tax Climate Index, which enables business leaders, government policymakers, and taxpayers to gauge how their states’ tax systems compare, Wyoming was once again ranked #1 for 2020. This Wyoming tax haven is good news for those looking for real estate in Jackson Hole.

Wyoming has such convincing tax advantages over other states in the US that the cost of moving or establishing a primary home or business in Jackson Hole may even be mitigated. As real estate professionals in Jackson Hole, it is gratifying to understand the amount of money that clients can save in taxes when they create a residency in Wyoming. Wyoming has no state income tax, no state gift tax, no inheritance or estate tax, and no capital gains tax.

Consider this comparison of a sale of stock by a Wyoming resident vs a resident of a state with a 10% capital gains tax rate. If they each have a gain on the sale of the same stock of $200,000, the non-Wyoming resident might pay up to $20,000 in state taxes alone. The Wyoming resident does not pay any state capital gains on the same sale.

But the advantages to living in Wyoming don’t end there.

Wyoming’s Economic Health

Residents of Wyoming receive significant tax benefits due to its state budget surplus, tax certainty, and asset and creditor protection. Wyoming has a progressive rule against perpetuities, updated trust laws, and privacy protection for Limited Liability Companies.

When compared to higher-tax states such as California, New York, Illinois or Maryland, it becomes clear why Jackson Hole, WY is experiencing an uptick of tax-motivated buyers. Here are some examples of Wyoming’s fiscal health and tax advantages of living in Wyoming:

- Wyoming’s Permanent Mineral Trust Fund (PWMTF) has a balance of nearly $8.1 billion as of 2018.

- Wyoming’s Legislative Stabilization Reserve Account (LSRA), has a balance of nearly $2 billion.

- The state of Wyoming made $240 million in investment income for the fiscal year 2019.

- Wyoming has a AAA credit rating, the highest possible and better than the Federal Government.

Tax Advantages of Living in Jackson Hole

Wyoming Has No Income Tax

In fact, state income tax is constitutionally prohibited. As one of only seven states in the United States that does not levy a personal income tax, tax advantages of real estate ownership in Wyoming become even more compelling.

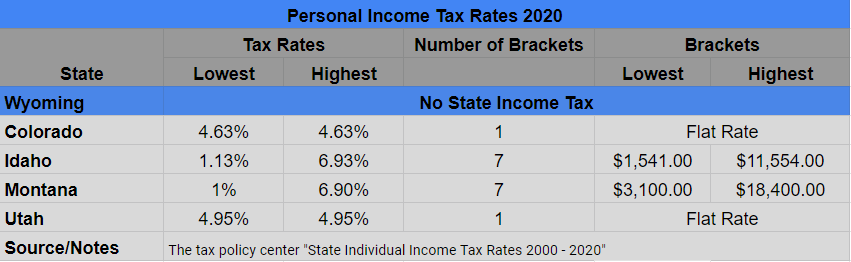

The chart below summarizes personal income tax rates for Wyoming and the other Rocky Mountain States for 2020. Numerical rankings are tabulated by excluding states with no personal income tax (as well as New Hampshire and Tennessee, which charge income tax only on dividends and interest) and are based on the highest possible tax rate for which an individual might be liable.

Wyoming as Tax Shelter – No Estate or Inheritance Taxes

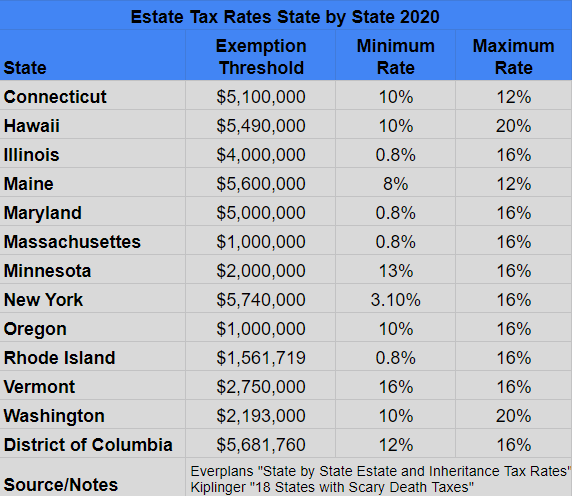

In response to changes in federal law that phased out the “pick up” tax in 2005, some states chose to enact laws that allow the state to collect a state estate tax. Wyoming did not enact this law and, therefore, does not collect a state estate tax, which was and still is the case in Wyoming. The chart below illustrates a comparison of other states’ estate or inheritance tax rates.

Wyoming’s Rule Against Perpetuities – Advantages of a Trust in Wyoming

Wealth that can avoid estate tax levy will grow more than wealth that is subject to estate tax in every generation. The Dynasty Trust allows individuals an alternative to giving their wealth to their heirs directly. In a “dynasty trust,” wealth can benefit many generations of a family without being subject to estate tax at each generation.

Dynasty trusts are an excellent opportunity for wealth preservation. With multi-generational planning, you can give your family generations of tax-protected, creditor-protected, failed marriage protected wealth. This allows the family— rather than the state—to dictate how long a trust can last.

Wyoming’s Business Tax Climate

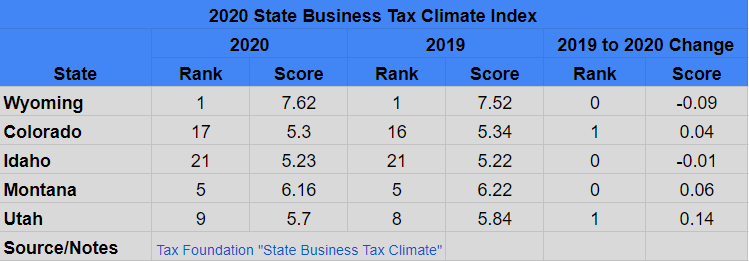

The Tax Foundation recently released a report evaluating business tax systems for the fiscal year 2020. The report ranked the states by analyzing variables in five general tax areas: corporate taxes, personal income taxes, sales taxes, unemployment insurance taxes and property taxes. Wyoming tax laws offer residents significant business advantages and the state was ranked #1.

States were scored on a scale of 0 to 10, with 0 indicating the worst business tax structure and a score of 10 indicating the best. States were then ranked on a scale of 1 to 50, with a ranking of 1 indicating the state with the best business tax climate and a score of 50 indicating the state with the worst. For the fiscal year 2020, Wyoming’s business tax climate was ranked first in the US. The state also ranked first in corporate tax rank and individual income tax rank. See the table below:

Wyoming Has No Corporate Income Tax

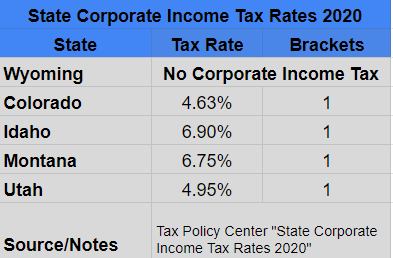

Starting or moving a company to Wyoming can be a smart idea for business proprietors. With no corporate income tax, many companies are realizing significant savings by locating their business within Wyoming. For more than 10 years, Wyoming has ranked #1 for business-friendly taxation on Tax Foundation’s annual State Business Tax Climate Index.

The table below lists the corporate income tax rates for the surrounding states in 2020.

Wyoming Offers Important Creditor Protection

An LLC in Wyoming offers favorable creditor protection legislation. The 2010 Wyoming Limited Liability Company Act provides excellent asset protection by mandating that, even in the case of a single-member LLC, a charging order is the sole remedy available to the creditors of members of a limited liability company. This LLC Act allows Wyoming to offer limited liability owners more significant protection against personal creditors than most other states in the US.

Creditor protection is one of the reasons clients create statutory entities for their businesses in Wyoming.

Tax Benefits of Land Conservation

Through a conservation easement, property owners place permanent restrictions on the amount of future development on all or some of their property. This will protect an identified use, such as scenic, wildlife, and/or ranching resources. The restrictions usually limit the number of future homesites and other purposes. Conservation easements allow landowners to continue to own and use their land.

The donation of a conservation easement to an organization such as the Jackson Hole Land Trust permanently protects conservation values that are beneficial to the public and can often qualify as a tax-deductible charitable donation.

In many ways, Jackson, Wyoming really does have it all …incredible scenery within the Greater Yellowstone Ecosystem, unmatched outdoor recreational opportunities, a vibrant cultural scene and an attractive tax climate. For further information on the tax benefits of Wyoming, please contact a Jackson Hole based tax advisor.